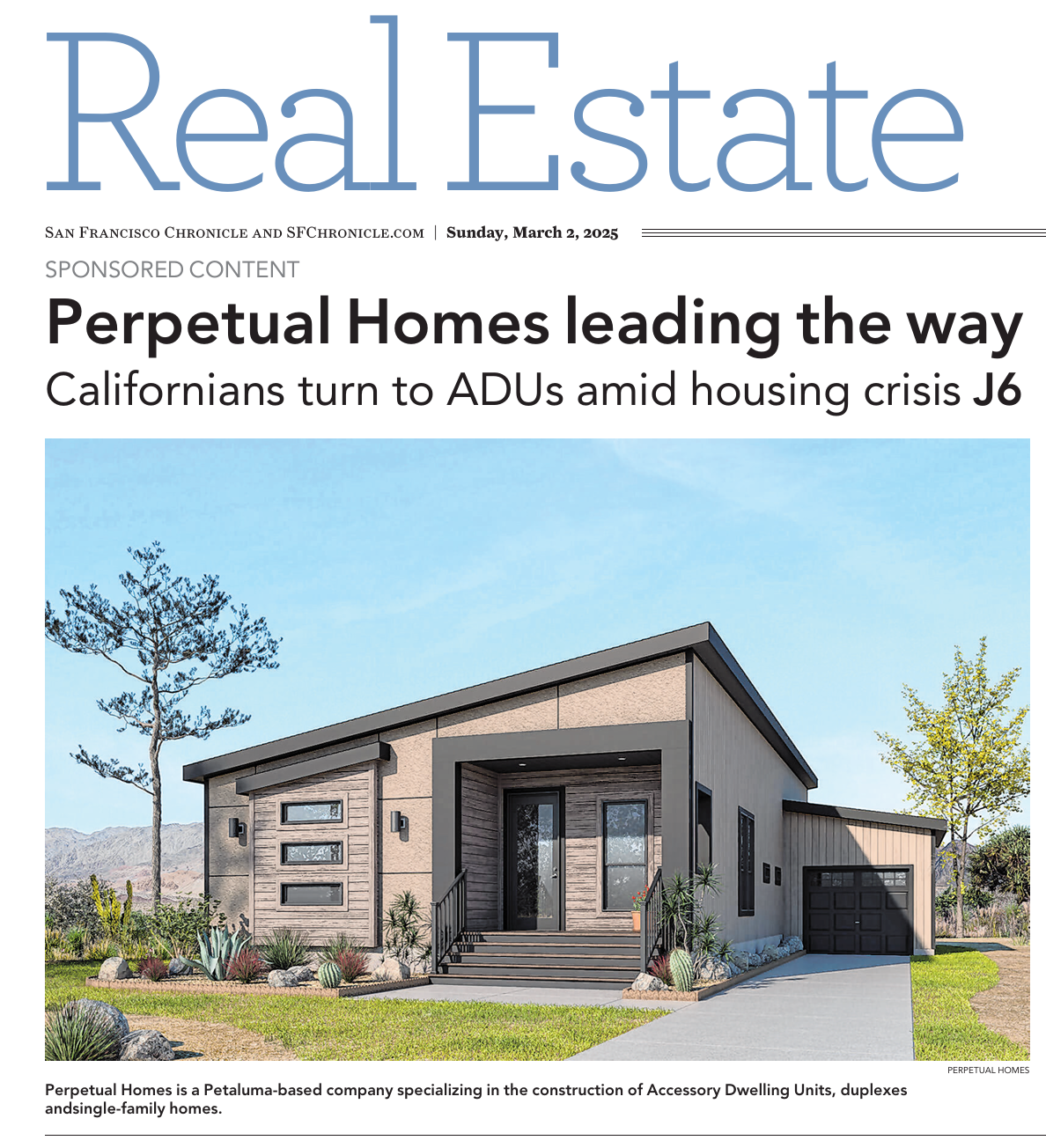

Guest House vs. ADU: Breaking Down the Difference

Deciding between a guest House and an Accessory Dwelling Unit depends on your specific needs and reasons. A Guest House offers separate accommodation on your property, suitable for visitors or potential rental income. It provides privacy but may have regulations and construction cost limitations. On the other hand, an ADU refers to a self-contained living space within your existing home or attached to it. ADUs offer versatility and can serve as a rental unit, home office, or additional living space. They often have more streamlined regulations and might be more cost-effective than building a separate Guest House. However, the choice depends on your budget, space availability, and long-term plans. option.

Guest House vs. ADU - which option is best for you?

The primary difference between a guest house and an ADU is their size, function, and legal status. The guest house is typically a standalone structure that facilitates daily living, containing bedrooms, living spaces, and utilities. Despite this, an ADU is a smaller, secondary residential unit on the same property as a main house. ADUs can take various forms, such as granny flats, garage apartments, or backyard cottages. It offers a functional living space with a kitchen, bathroom, and separate entrance. From a legal perspective, guest houses are usually subject to standard zoning regulations. While ADUs may be subject to additional local ordinances governing their size, location. ADUs provide versatile and often more affordable housing options, contributing to addressing the housing shortage crisis and offering homeowners potential rental income. For better outcomes, consulting professionals and considering your goals will help determine you best

The comparative financial Analysis of investing in Guest houses vs. ADUs

Investing provides profitable financial opportunities, with guest houses and ADUs evolving as popular options for investors. This analysis explores the financial aspects of investing in these two types of properties, including ROI, property value appreciation, and Tax implications. Additionally, what are the financial benefits of each option? Which is best for you?

Guest Houses:

Guest houses are standalone structures on a property that can serve as accommodations for visitors. When considering the financial aspects of investing in guest houses, several factors come into play:

● Guest houses can generate rental income through short-term or long-term rentals, providing a consistent revenue stream.

● Well-maintained guest houses can enhance the overall property value, especially if they have unique amenities or features.

● Rental income from guest houses is generally subject to taxation. However, tax deductions may be available for expenses related to the upkeep and maintenance of the property.

● Guest houses require ongoing maintenance, which can include repairs and renovations. At the same time, these costs need to be factored into the financial analysis.

ADUs:

ADUs are self-contained residential units on the same property as the main residence. They are often used as rental units or housing for family members. Here are the fundamental financial considerations for investing in ADUs:

● Like guest houses, ADUs can generate rental income, contributing to the property owner’s cash flow.

● The presence of ADUs can boost property values, especially in markets with limited housing supply and high demand for rental units.

● Taxation of rental income and potential deductions for expenses also apply to ADUs. Tax laws may vary based on the location.

● ADUs will also inquire about ongoing maintenance costs, which must be factored into the overall financial analysis.

Comparative Analysis

● Both guest houses and ADUs offer potential rental income. The rental rates will depend on location, property size, and local market conditions.

● Both options can contribute to property value appreciation, potentially leading to higher returns upon sale.

● Tax implications of rental income and expense deductions apply to guest houses and ADUs, with variations based on jurisdiction.

Although the difference between the guest house and ADUs will depend on individual needs and investment goals. However, it is suggested that you consult with financial advisors and real estate professionals to make an informed decision based on your unique circumstances.