How a remote work boom and city exodus might reshape rural America

Pictured: Zoom Conference Call

The Great Work-From-Home Experiment carries on as the country continues to be shelled by Covd-19. Fortunately, most people involved — companies and employees alike — think that it’s working pretty well, except those trying to work and take care of kids simultaneously.

According to a recent survey by Deutsche Bank that has tracked sentiment, we may be at “peak WFH”: 65% of respondents said they expect to work from home at 1-3 days per week when their offices reopen, compared to 65%, 57%, and 39% in the past three months.

At the same time, there have been heaps of anecdotes about people who can afford to leave high-cost cities like New York, accelerating planned moves to the suburbs and taking advantage of a remote work policy to live in cheaper areas.

The scale of the urban exodus is unclear at the moment. Anecdotally, many people think people are leaving the city in droves. However, Zillow’s chief economist says people aren’t leaving in droves (at least not yet).

However, rents in cities are dropping — 6.6% in New York, according to Douglas Elliman — which suggests this is happening enough to move the market.

But just as interesting: How this will affect the small towns and cities these workers flock to?

American cities have attracted young people with jobs and urban amenities, and smaller, more rural regions have struggled with brain drain and keeping their young people. Some states, like Vermont, have experimented with incentives, such as famously paying some people $10,000 to move and work remotely there.

For states and towns that have long wanted revitalization, the coronavirus pandemic could have an interesting knock-on effect, with the potential to bring people back who left for more job opportunities.

Decentralized jobs could revitalize small towns

The country’s biggest companies are often clustered together in economic hubs — big cities. For years, it made sense as that’s where the biggest labor pools were and companies would position themselves to take advantage of them.

But with the pandemic pushing people into isolation, the need to be physically proximate has evaporated since technology provides the virtual connections to keep productivity going.

Some companies are talking about more permanent remote-work options for employees — flexibility for workers and lower costs for employers — so it may be a trend that sticks, at least for some businesses.

Already, some people have left cities, choosing to live where they want to, not where their jobs are located.

“I think it’s really a potentially positive development for rural areas or less densely populated areas,” said Isabel Sawhill, a senior fellow at the Brookings Institution who studies the middle class and social mobility. “This is a big country and we have lots of inexpensive real estate, it’s just that there aren’t jobs in those places — and this would be a way to bring a lot of jobs to people who need them in rural areas and small towns.”

Jobs can be brought in two ways: people coming and people already living somewhere deciding to apply. If working remotely is viable for a company, their labor pool theoretically expands to the entire country.

Sawhill and Mercer’s HR experts Mary Ann Sardone and Matt Stevenson, said that often small hubs can pop up when people are given the green light to work remotely, as workers choose “nice” places to live unrelated to their workplace. Sawhill pointed out that these scenarios often raise the entire town’s economic profile by providing employment for essential infrastructure like grocery stores and barber shops.

Sometimes, Stevenson said, a place that begins as a low-cost “small town” ends up losing its bargain status over a period — like Fargo, N.D., after Microsoft employees began to cluster there in 1999 when it opened a small campus.

Critical mass makes all the difference

If enough young, upwardly mobile workers move, things change, says Charles Whelan, an economics professor at Dartmouth College in Hanover, N.H., a small town of 11,500.

But if you don’t have enough young people, it’s going to be tough to sell a smaller town.

“There’s still a lot of appeal to the city, high prices notwithstanding,” said Whelan. “You don’t have to have a car.”

If you’re under age 30 and single, things may be tough. Stevenson said being young and living in a small town means you’re “kind of exiled,” and Whelan said he wouldn’t “wish it on anybody.”

For a young family, Whelan said, it’s much different — especially families with two earners that may face hard choices about where to live because of their jobs. If one can work remotely, it’s no problem if the other’s job is in a fairly rural place.

Another issue is what happens to employees who leave the office with the company’s blessing. Will those workers who decide to go to rural areas and set up co-working spaces be seen as clock-punchers while their coworkers who remain at HQ get the promotions?

"You run the risk of creating two parallel work forces," said Stevenson. "You don't want the best people going out to the countryside missing out on the career track."

Micropolitan areas and college towns

One potential area of growth is in village-like smaller towns and cities that offer some amenities similar to urban places, but with more room and fewer people. With an economic center like a hospital or a university, these are often well set up to attract people fleeing urban environments.

“I think it creates an economic hub,” said Sawhill. “It also brings in a group of people who are better educated and likely to make investments in time and money in that community.”

Sawhill and Whelan pointed out that there is substantial research behind this phenomenon. Once you have a hub like a hospital, Whelan said, everyone else comes. “You have architects, wealth management people, lawyers — that’s why college towns work,” he said.

In the short term, however, things look tough for college towns dealing with the possibility that life will not be the same this fall under the pandemic. As Yahoo Finance has reported, closures take an enormous toll on college towns that would need a significant city exodus to replace.

Internet is key to the future

Every expert who spoke to Yahoo Finance for this story mentioned internet connectivity as a must for all of this to work out. While things are improving, there is still plenty of work to be done to connect smaller, more rural places that fall through the cracks when the phone and cable providers prioritize. According to the FCC, 80% of the 24 million Americans without good internet live in rural areas.

Matt Dunne, a politician, businessman, and director of the Center for Rural Innovation in Vermont, pressed the internet issue and the fact that scrappy collectives of towns had managed to put together fast connections on their own.

Dunne has been trying to figure out how to revitalize the country’s more rural parts and told Yahoo Finance that the opportunity gap continues to widen between cities and towns – since 2008 traditional rural jobs have been automated, globalization continued to take off, and entrepreneurship declined in rural areas.

In his view, Covid-19 has the potential to be a boon for rural communities.

“I think it’s accelerating things in an unbelievable way where tech companies aren’t requiring people to actually be in a city and all go to the same office,” he said.

The hope, Dunne said, is that there aren’t just three hubs where everyone wants to go to, but rather that workers see the whole country as a potential place to be where jobs can be had — and training can be possible for people to enter the workforce without a detour in New York or San Francisco. Inclusivity is key.

Unfortunately, like college towns that are being crushed by closures and reduced economic activity, small towns that rely on tourism are being hit as well by Covid shutdowns and a more cautious public.

“The other analysis we did recently was to show rural places are much more vulnerable to job loss in the Covid response – that’s because of the nature of the kinds of jobs,” said Dunne. “Places with heavy dependence on tourism are just getting shellacked.”

However, the next few years shake out with the Covid crisis and the Great Work-From-Home Experiment either working or not working for businesses, a lot is up in the air. As Dunne pointed out, the housing market in the northeast has exploded as people look for a place to buy to escape the city — a move that could put pressure on those who live there already. It seems as if trends are accelerating, but as of yet, it’s hard to say which direction they’re going.

Written by Ethan Wolff-Mann

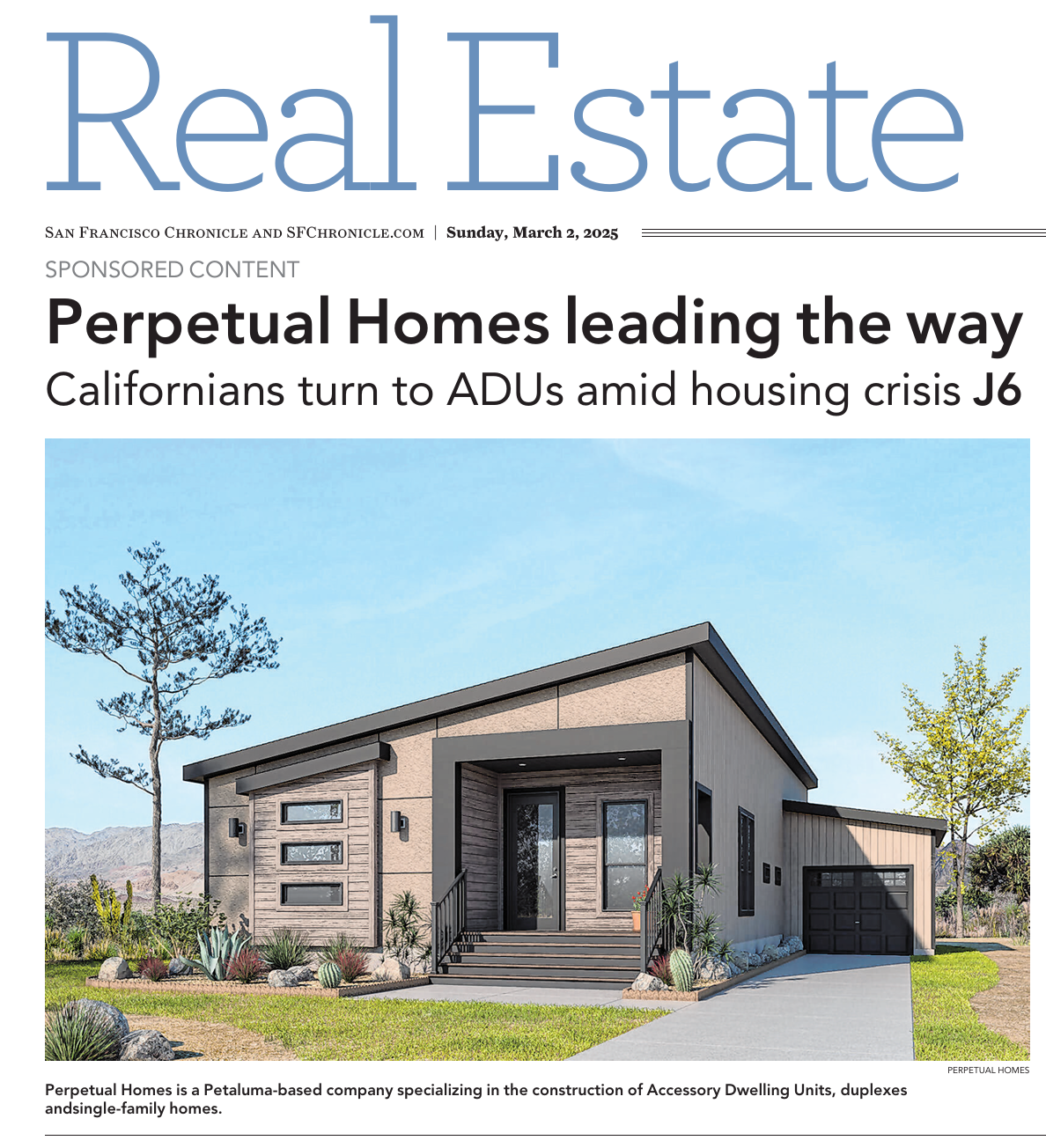

The highly regarded ADU builder, Perpetual Homes, specializes in providing affordable, sustainable, turn-key backyard ADU’s in the Bay Area. Perpetual Home ADU’s are placed on a permanent foundation so they are earthquake resistant. Assembled off-site to ensure the highest standards of quality, with minimal disruption to the homeowner, Perpetual Homes offers a huge array of floor plans/exterior design options, and dwelling sizes (that can range in size from the 160 sq ft office shack all the way up to two bedroom / 2 bath 700 square ft dwelling). To find out more about adding an ADU, visit www.perpetualhomesadu.com, email perpetualhomesadu@gmail.com, or call 925-980-2351.

adu | perpetual | perpetual homes | perpetual adu | perpetual homes adu | perpetualhomes | perpetualhomesadu | prefab | palo alto | accessory dwelling unit | accessory dwelling units | backyard home | backyard homes | bay area | california | granny flats | modular | granny flat | san jose | construction | tiny homes | homes